Professional Guidance for Retirement Accounts

Did you know professionally managed retirement accounts outperform self-directed accounts? Merit Financial Advisors can help. Your Merit financial advisor can provide comprehensive, personalized asset allocation and tax strategies across your full financial picture.

Make the Most out of Your Entire Portfolio

It's time to work with your financial advisor and consider your 401(k) as part of your full financial life for comprehensive management. At Merit, we’re dedicated to delivering comprehensive strategies to empower your financial decisions.

Effectively managing your investments and making informed financial decisions takes time, skill, and effort. You’ve hired your financial advisor to provide professional guidance, but there has been an important piece missing– the ability for your advisor to oversee your 401(k). Now, your Merit financial advisor gains the ability to proactively manage your 401(k) as part of your entire portfolio, so you can skip deciphering lengthy plan information and fund options on your own.

Help Secure Your Retirement

Proactive Management

Our advisors actively manage and rebalance your 401(k) and portfolio in an attempt to maximize growth and minimize risk.

Merit Personalized Models

Leverage our proprietary models to better position your asset allocation based on your risk tolerance and goals.

Comprehensive Strategy

Benefit from a holistic approach that aligns your investments, tax planning strategies, and retirement goals.

Robust Security

Your data is protected with dynamic encryption and multi-factor identification.

Transparency

Receive consolidated reporting on all your investments and retirement plans to see your comprehensive financial picture.

Your financial advisor can help you pursue your retirement goals.

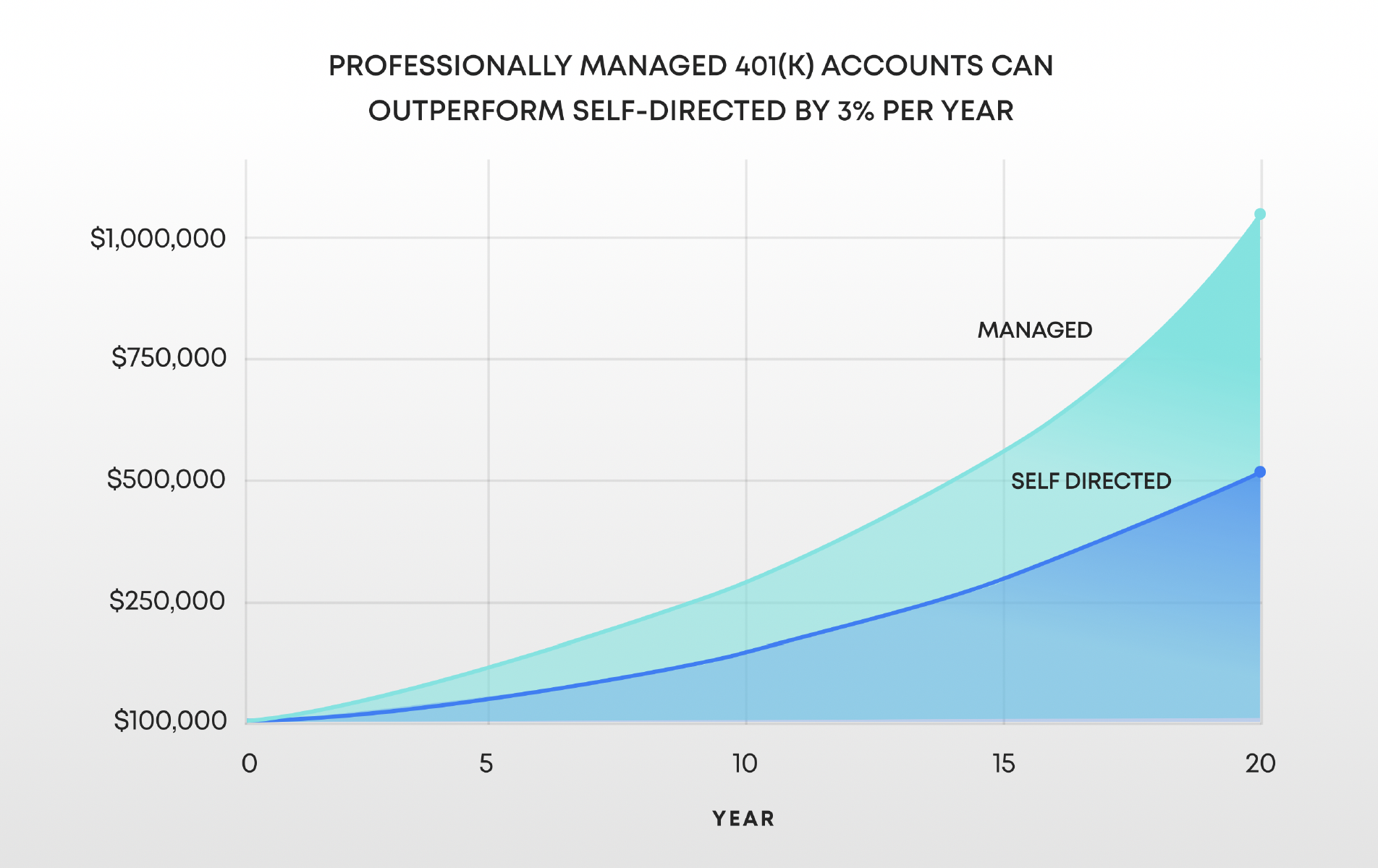

Studies show professional management of retirement accounts can grow them by 3% more per year; that's 75% over the span of 20 years.* As you near retirement, often times a more tailored plan is needed, and your financial advisor can help you pursue your goals.

All investing involves risk, including loss of principal. No strategy assures success or protects against loss. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs. Rebalancing and Asset allocation does not ensure a profit or protect against a loss.