November 2023 Market Update

November has been a great month for markets this year, snapping a 3-month losing streak after hitting a high at the end of July. The equity markets had a strong rally across the board with treasury yields falling from multi-year highs. Federal Chair Jerome Powell seems to be content with where rates and the economy are currently, giving the markets a sign of hope for no further rate hikes ahead.

The U.S. economy showed strong growth in the third quarter of this year, growing at an annual rate of 4.9%. This was a great surprise in comparison to when GDP was at 2.1% last quarter and 2.7% last year. The Atlanta Fed’s GDPNow model is currently predicting the fourth quarter GDP growth rate to be at 2.1%.

Manufacturing and job growth cooled down in October, but the labor market remains resilient with the current unemployment rate at 3.9%. Hiring momentum has begun to slow throughout most of the sectors. We have also begun to see an increase in consumer loan delinquencies with continued erosion in consumer excess savings.

The October CPI report showed inflation continuing in a slow decline, but it remains above the long-term federal target level. Headline CPI was unchanged over the last month and up 3.2% over the year, just 0.1% higher than forecasted. Falling energy and car prices have helped as main detractors for inflation this month.

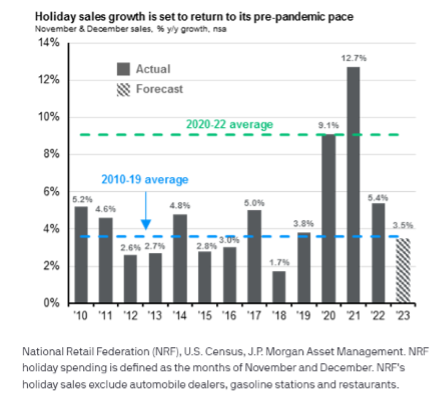

Current forecasts indicate that holiday spending this year will finally return to pre-pandemic levels. Due to large-scale government stimulus payments, holiday spending has been inflated over the past three years. Higher prices being passed to the consumer should also continue to weigh on consumer spending.

The geopolitical landscape is still a headwind for international markets with ongoing wars in both the Middle East and Eastern Europe. There does not seem to be much conviction behind a growing escalation in these conflicts, but we do expect to see countries continuing to provide aid through economic support.

In summary, the economic data this month has supported the growing possibility of a soft landing. If that perfect story doesn’t come to fruition, we can find ourselves in a “higher for longer” environment causing a weaker consumer, tighter credit conditions, and slower business activity that should weigh on the resilience of the U.S. economy. So, what does that mean for you? We are closer to the light at the end of the tunnel, but we’re not yet out of the woods. For now, play defense by making prudent decisions, exercising proper risk management, and identifying opportunities that will help mitigate potential headwinds.

For more information and guidance, please reach out to your Merit financial advisor.

Stay Connected. Stay Informed. Follow us on social media to be the first to hear about Market Updates!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.