October 2023 Market Update

As we head into Q4, certain pockets of the economy continue to show strength while others present potential headwinds for 2024. We’ve seen inflation moderate but remain elevated above historical averages. Adding geopolitical risks in the Middle East, headline inflation could stay above the Federal Reserve’s 2% target longer than expected. Economists and market participants have had to spend the last several weeks coming to terms with the possibility of “higher for longer”. While not all of the data is bleak, potential stumbling blocks are gaining more clarity.

The labor market remains a highlight as unemployment hovers below 4%, aided by robust hiring in services jobs. The ratio of job openings to total unemployed is at 1.5x1, implying that there are more jobs available than job seekers. With strong competition among employers for talent feeding into wage gains, consumers appear to be in a decent position to weather the rising costs of goods and services over the near-term.

Over the short to intermediate term, multiple factors could dampen consumer spending. The last remnants of the pandemic driven fiscal policies have mostly expired, including the payment pause on over $1.7 trillion in student loans.

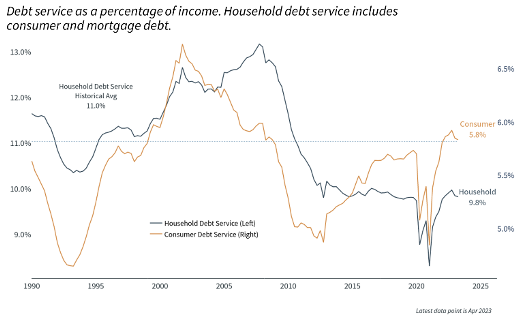

With those fiscal buffers falling off, savings rates have dropped below long-run averages. Borrowers have had to rely more on debt financing, particularly from consumer loans and revolving credit. Combining the increased usage of debt with rising rates, increased debt service will add pressure to household budgets. We’re not forecasting a collapse of the consumer by any means, but we expect households will be reducing consumption from the elevated levels we’re at today.

Shifting from consumers to the markets, there are overlapping themes across both spectrums. Companies have faced the same issues with rising rates and higher inflation. Production and labor costs have had a meaningful impact on the bottom line with year-over-year EPS falling 5%3 for S&P 500 companies. There has been a strong sense of cost management across various industries, giving the markets some solace that cost pressures have eased.

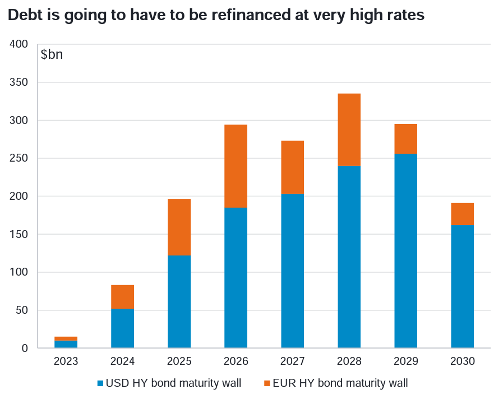

Looking forward, questions start to arise around the cost of capital. Many companies, like homeowners, were able to refinance at extremely low rates post-pandemic. That debt will eventually come due and bring on a new wave of refinancing at rates nearly 2x what we saw pre-pandemic5, potentially keeping earnings growth suppressed.

In summary, inflation is still high, lending rates are high, and both households and companies could have their spending ability squeezed. Where does that leave us? Making prudent decisions, exercising proper risk management, and identifying opportunities that will help mitigate potential headwinds. Although this sounds like a shift to only play defense, these are foundational components to constructing a well-diversified portfolio. Focusing on creating a long-term plan that meets your needs and risk budget will provide you with the best opportunity to navigate through near-term concerns in the economy.

- Calculated by dividing the August 2023 reading of Total Nonfarm Job Openings by the US Unemployment Level, as provided by the Bureau of Labor Statistics. U.S. Bureau of Labor Statistics, Job Openings: Total Nonfarm [JTSJOL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/JTSJOL. U.S. Bureau of Labor Statistics, Unemployment Level [UNEMPLOY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNEMPLOY.

- ‘Debt service as a percentage of income’ source: Clearnomics, Federal Reserve.

- Bloomberg estimated S&P 500 EPS growth for 2023 Q2.

- ‘Debt is going to have to be refinanced at very high rates’ source: Fidelity International, Bloomberg.

- Based on average YTM of the Bloomberg US Corporate Bond Index on 12/31/2019 (2.9%) vs 9/30/2023 (6%).

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. All investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.